Tax incentives and rebates can help you cover the cost of making changes to your home that will help you use less energy. In addition to already existing federal incentives, the Biden Infrastructure Bill is giving states millions of dollars more to help their residents save energy, go solar, and even buy an electric vehicle.

Every state decides for itself how it’s going to dole out its rebate funds. Every state also has some tax rebates and incentives already in place to help consumers become more energy efficient and help fight climate change.

Here’s how to find energy-saving tax incentives that will help you cover your costs

The NC Clean Energy Technology Center at N. C. State University has created DSIRE, a state-by-state list of incentives and policies that support renewable energy and energy efficiency in the U.S.

Its interactive map (like the one below) lets you click on your state to find out what financial benefits are already available to you. The benefits may be rebates, or they could be tax credits.

TO CLAIM A TAX CREDIT:

Make your upgrade: Select appliances and home improvements from the list on Energy.gov. The list includes air conditioners, clothes dryers, electric stoves or ovens, heat pumps and hot water boilers, induction cooktops, water heater heat pumps, energy saving smart technology and much more. Home improvements can include battery storage, electric vehicle home chargers, exterior doors, insulation and air sealing materials, solar panels, windows and even wind turbines.

Claim your tax credit: Submit IRS form 5695 when filing your taxes.

Receive your tax credit: The qualifying amount will be subtracted from your federal taxes, either giving you a bitger tax return or lowering the amount you owe.

TO CLAIM A REBATE:

Your state, territory, or Tribe manages rebates for energy efficiency and appliance upgrades. They will determine which products are eligible for rebates. EPA’s Home Energy Rebates Portal will tell you the status of those options where you live.

You may qualify for both tax credits and rebates.

For example, suppose you want to insulate your home. That makes a lot of sense, because reducing the amount of air that leaks in and out of your home through your attic, windows, or crawl space will cut heating and cooling costs, along with increasing living comfort and creating a healthier indoor environment.

Home insulation can qualify for both a tax credit and a rebate.

Before proceeding, check here to make sure you meet the requirements for a home energy tax credit. Generally, the tax credit will cover 30% of what you pay for insulation up to a cumulative annual cap of $1200.

You may also be eligible for your locality’s Home Energy Rebates program. The program provides up to $4,000 for projects that reduce household energy use by 20% or more. Or, it provides $8,000 for projects that reduce household energy use by 35% or more. Here’s where your state stands on providing home energy rebates.

If you don’t know what upgrades or changes to make, EPA recommends you either get a professional home energy assessment (which tax incentives may pay for), or conduct a do-it-yourself assessment.

The advantage of the professional assessment is that it can pinpoint exactly how much insulation you need to install in an attic, crawlspace or wall in order to save the most energy, or which lights to change out to make the biggest difference. The advantage of a DIY assessment is that it can familiarize you with your home’s efficiency needs so you can take immediate action.

EPA suggests that, even if you do a preliminary DIY assessment, hire a professional to give your home a look.

What to Do First? Make a List of Priorities

Most people can’t do everything all at once, so it helps to make two lists: what’s a priority, and what can you do now that you can afford?

What You Can Probably Afford Now And Don’t Need an Incentive For:

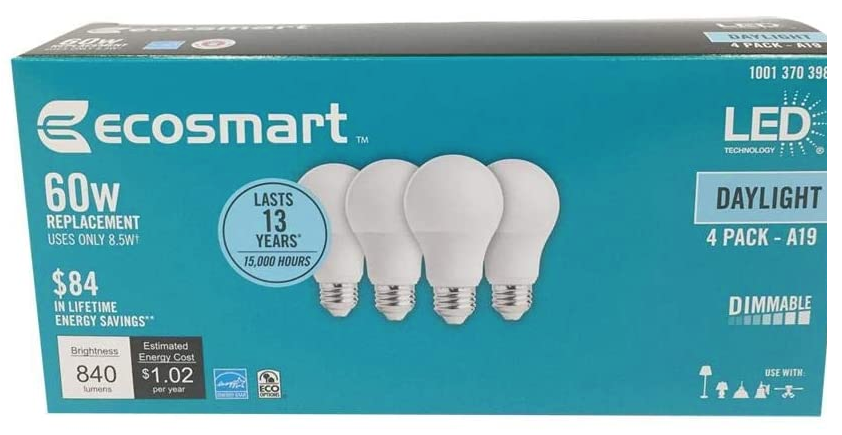

- Switch to LED energy-saving light bulbs (Here’s how to choose the best LED bulbs for your home or apartment.)

- Install a programmable thermostat, or simply adjust your thermostat up or down when you leave home, return home, go to bed, and get up in the morning

- Turn off lights and electronics when you’re not using them, or plug them into a power strip so you can turn everything off with the flip of one switch

- Use existing appliances like dishwashers and washers and dryers efficiently. That means full loads for both, and for clothes, washing in cold water when you can.

- Wearing warmer clothes in winter and cooler clothes in summer to reduce expensive heating and cooling bills.

What You Might Need an Incentive or Rebate For:

- A new electric or induction stove

- A new water heater

- A new heat pump

- Attic, crawlspace, and wall insulation

- A new air conditioner

- A new refrigerator (Here’s how my utility gave me $200 when I bought my new energy-saving fridge.)

The rebates and tax incentives under the Biden Infrastructure Plan last until 2032, so you have a good eight years to offset the costs of some of the bigger appliance purchases. My approach is to replace things as they break or wear out, rather than to do them all at once. Maybe that will work for you, too.

For more information, EPA’s ENERGY STAR portal makes it easy to find rebates by zip code, as well as to determine what tax credits you may be eligible for.